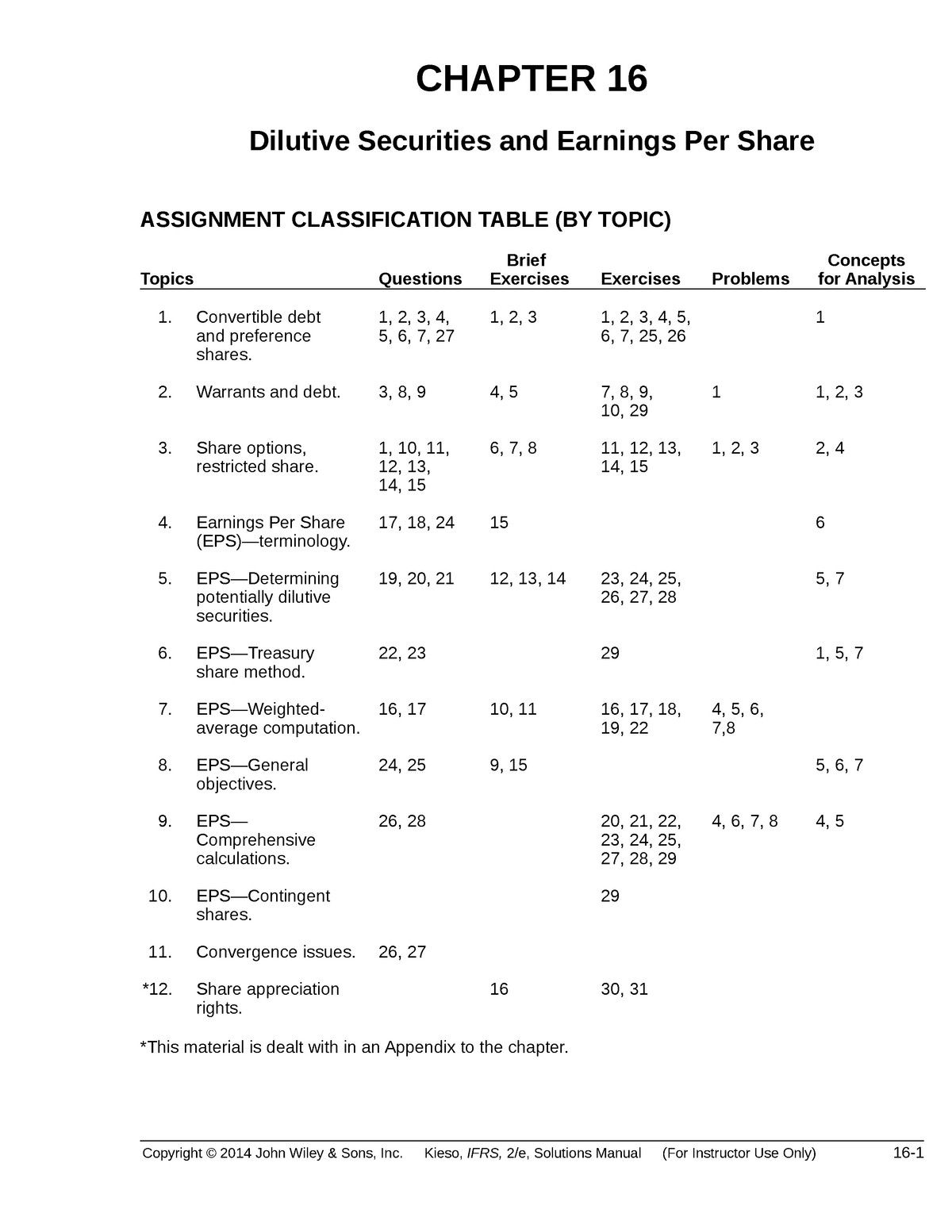

These employee stock options are often granted instead of cash or stock bonuses and act as incentives. When the option contracts are exercised, the options are converted to shares and the employee can then sell the shares in the market, thereby diluting the number of company shares outstanding. The employee stock option is the most common way to dilute shares via derivatives, but warrants, rights, and convertible debt and equity are sometimes dilutive as well.

Fully Diluted EPS

After all, by adding more shareholders into the pool, their ownership of the company is being cut down. That may lead shareholders to believe their value in the company is decreasing. In certain cases, investors with a large chunk of stock can often take advantage of shareholders that own a smaller portion of the company. EPS is also used in merger analysis where public companies analyze if a sizable acquisition will be potentially accretive or dilutive to their earnings.

Real-World Example of Dilution

That is to say, the worst anti-dilutive unit will be entered into the calculation first. If warrants equivalent to 100,000 common shares are outstanding, including them would change the result to $7,000,000 / 1,500,000, or a loss of only $4.67 per share. When calculating earnings per share (EPS), including the effects of a potentially dilutive security sometimes produces a higher per-share figure. For example, companies in the technology industry may have more stock options and warrants than companies in the manufacturing industry.

Dilution Template

Dilutive securities include options, warrants, convertible debt, and anything else that can be converted into shares. Full ratchet anti-dilution works by providing investors with the highest level of protection against dilution. When a company issues new shares at a price lower than what previous investors paid, the full ratchet provision resets the conversion price of the investor’s convertible securities to this new, lower price. This means that the investor can convert their preferred shares or convertible debt into common shares at the same price as the new investors. Convertible equity is often called convertible preferred stock and usually converts to common stock on a preferential ratio. For example, each convertible preferred stock may convert to 10 shares of common stock, thus also diluting ownership of existing shareholders.

- When new stock issues hit the market at a lower price than that paid by earlier investors in the same stock, equity dilution can occur.

- After all, by adding more shareholders into the pool, their ownership of the company is being cut down.

- The potential upside of raising capital in this way is that the funds the company receives from selling additional shares can improve the company's profitability and growth prospects, and by extension the value of its stock.

How Do Shares Become Diluted?

So, you will still get your piece of the cake only that it will be a smaller proportion of the total than you had been expecting, which is often not desired.

When an ordinary loss occurs in a year, all potential savings from conversions and all potential increases in the number of shares are anti-dilutive. The most widespread application for diluted shares is in calculating the company’s earnings per share (EPS). It is a common metric used by investors to assess the relative value and profitability of a company with its peers. Fully diluted EPS is important for investors, analysts, and companies to assess the impact of various securities on the company's earnings per share. It is also useful for comparing companies in the same industry and can impact the stock valuation of a company.

Share dilution may happen any time a company raises additional equity capital, as newly created shares are issued to new investors. The potential upside of raising capital in this way is that the funds the company receives from selling additional shares can improve the company's profitability and growth prospects, and by extension what is the journal entry to record sales tax payable the value of its stock. If converted, dilutive securities effectively increase the weighted number of outstanding shares, decreasing EPS, and thereby devaluing a shareholder's existing equity stake. Weighted average anti-dilution provisions are generally viewed as more company-friendly than full ratchet provisions.

The Treasury stock method is used to calculate diluted EPS for potentially dilutive options or warrants. The options or warrants are considered dilutive if their exercise price is below the average market price of the stock for the year. After-tax interest on the convertible debt is added to the net income in the numerator and the new common shares that would be issued at the conversion are added to the denominator. In securities, when a company’s value or earnings per share (EPS) is reduced, that results in a dilutive effect. This can happen during a merger or acquisition when the number of common shares is increased and the target company’s profitability is lower than that of the acquiring company. The extent of the reduction in EPS is directly proportional to the percentage increase in the number of shares.