They have a wide range of responsibilities, from managing bookkeeping staff to working on more strategic initiatives. Outsourcing your bookkeeping tasks can make a significant difference in the day-to-day operations of your business. The staff who previously managed these responsibilities will be free to work on new projects that help to grow the business, resulting in improved morale and productivity. When a business outsources its accounting, it essentially transfers responsibility for some or all of its accounting tasks to a third-party accounting firm. Among all these day-to-day activities, it can be difficult to find time for your accounting, even though you know how important it is to your business.

What is finance and accounting outsourcing?

By partnering with an outsourced accounting services firm, business owners can free up the time they would have spent managing their accounting department to focus on running their business. But there’s more than one virtual accounting company in the world, and solutions range from on-demand CFO services to simple pay-by-the-hour book balancing. Below, we review the best virtual and outsourced accounting services for small-business owners like you. Keeping track of financial data for a business takes time, effort, and money.

Much like outsourced bookkeeping, there are few disadvantages inherent in partnering with an outsourced controller. There’s also the consideration that an outsourced controller has many additional skills that can benefit your business. This might include a knowledge of tax strategy, insights as to how you should structure your personal compensation to be tax-efficient, and more. Controllers are more advanced finance professionals that are usually responsible for managing the day-to-day financial operations of a business.

Benefits of outsourcing bookkeeping

As alluded to in the previous step, outsourcing isn’t a “set it and forget it” solution. As your business changes or grows, continuously assess whether the agreement is continuing to meet your business needs. Also, take all relevant steps to protect sensitive financial and employee information during data transfers. This will help minimize the potential for data misuse, keep your data secure, and ensure you’re compliant with any relevant data protection laws in your region. Directly engage with potential providers and request a meeting to discuss your needs.

- Enter some basic information about your current accounting needs and we'll send you up to five customized quotes.

- To make important business decisions, leaders need access to timely, precise financial data.

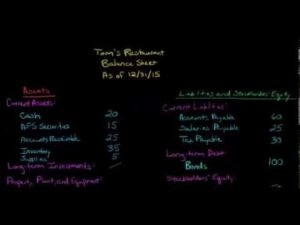

- Most other virtual bookkeeping services give you basic financial reports only, like income statements and balance sheets.

- But while most professionals know QuickBooks as a software-only solution, Intuit’s financial forerunner’s offerings are much broader than that.

- Once you’ve established what you want to outsource, the next next step is to identify who you’re going to outsource it to.

Common Outsourced Accounting Myths

For example, a bookkeeping firm may hire professional bookkeepers with certifications. And if your current bookkeeper needs to take a leave of absence, the firm can replace them with another bookkeeper to fill the gaps. FreshBooks is an accounting software for small businesses, freelancers, self-employed professionals, and businesses with employees. The above reasons aren’t the only signs that you should outsource your bookkeeping. In virtual fundraising event invitation general, the sooner you start with outsourced bookkeeping, the faster you’ll see its benefits.

Earlier in the article, we discussed different ways to outsource bookkeeping. Here’s a more detailed activity method of depreciation example limitation overview of the 2 main ways outsourced bookkeeping works. CPAs and similar organizations follow the best practices in the industry. They adhere to most standard procedures to remain high-quality service providers. Firms and freelancers can be local or virtual, though most bookkeeping firms will opt for a virtual system over a physical one.

However, provided your outsourced bookkeeping partner embraces cloud-based accounting software, you’ll have access to your books 24/7. Today, many outsourced accounting providers are purpose-built for the needs of private businesses, from closely-held family businesses to well-established mid-market firms. The accounting needs of these types of businesses are different from those of larger firms, and the services available to clients reflect that. If you’re curious about what that process looks like, you’ve come to the right place.

Outsourcing some or all of your accounting needs to an calculate markup external third party can represent a major win for business owners. Additionally, when you outsource bookkeeping, you lose the ability to walk over to your bookkeeper’s desk and ask them a quick question. This can make it feel like you have less control over your accounting.